What is Copay?

On Medical Bills. Under this category, the copay clause is applicable to all the claims raised, irrespective of whether it is voluntary or mandatory. You will thus need to pay a portion of the claim amount thus raised. On Senior Citizen Policies. These are the policies that mostly come with mandatory copay clauses. A copay status assigned to a Veteran who is required to make medical care copay based on financial status relative to the applicable annual income limits. A jointly funded federal and state program that provides hospital expense and medical expense coverage to persons with low-income and certain aged and disabled individuals. Understanding Insurance. In simple terms, insurance is a method of sharing the unexpected financial losses of an ‘unfortunate few’ from a common fund formed out of contributions of the ‘many’, who are equally exposed to the same loss (Spreading of the losses of an individual over a group of individuals). A copayment or copay is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a certain.

A copay or copayment is the amount of money you are required to pay directly to the healthcare provider (doctor, hospital etc.) per visit, or to a pharmacy for every prescription filled.

Copays discourage unnecessary visits by making the patient responsible for a small portion of her healthcare costs. Copays are typically $15 to $50 per visit but may vary depending upon the following factors:

- Specialists vs. General Physicians: Copays for specialist visits are usually higher than for general physicians.

- Generics vs. brand name drugs: Copays for prescription drugs are around $5 to $20 per prescription, with lower copays for generics vs. brand name drugs. This provides an incentive to lower costs by using drugs that are chemically equivalent but cheaper.

- In-network vs. Out-of-network: Insurance companies contract with healthcare providers to agree upon reimbursement rates. When you see a provider 'in-network' — i.e., a provider that the insurance company has an agreement with — you may pay a lower copay than when you see a doctor out-of-network.

Copays are applicable until the annual out-of-pocket maximum is reached but many insurance plans waive copays for preventive care visits like annual physicals or child wellness checkups.

High-deductible health plans (HDHP) usually do not have a copay.

What is Coinsurance?

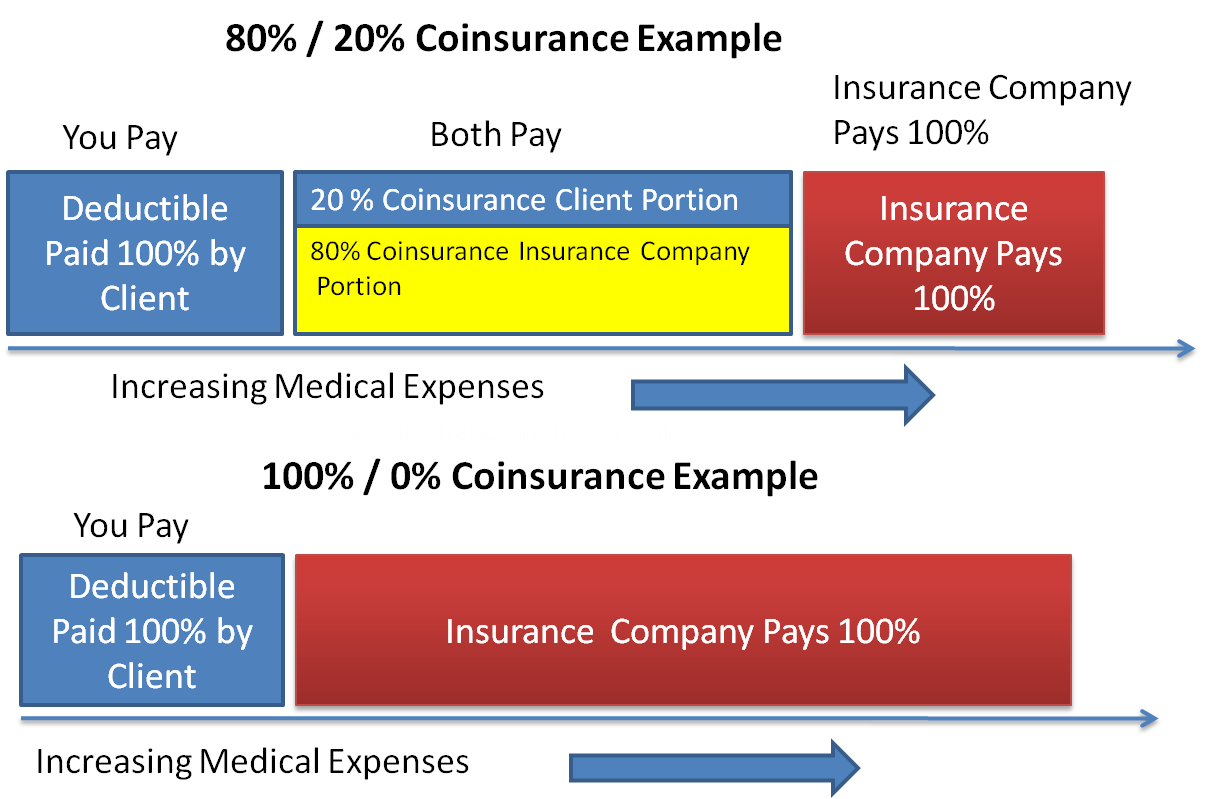

The copay is usually too small to cover all of the provider's fees. The provider collects the copay from the patient at the time of service and bills the insurance company. If the provider is in-network, the insurance company first lowers the 'allowed amount' to the pre-negotiated rate for that service (more about this in the example below). If the deductible has been met, the insurance plan then covers a large percentage (usually 60-90%, depending upon the plan) of the allowed amount. The patient is responsible for the balance (10-40% of the allowed amount). This balance is called coinsurance.

Coinsurance may be higher when you see an out-of-network provider, but stays the same whether you see a GP or a specialist.

What Does No Copay Mean

What is a Deductible?

The annual deductible specified in your plan is the total coinsurance you must pay in a calendar year before the insurance company starts paying for any healthcare costs.

Do copays count toward the deductible?

No, copays do not count toward the deductible. However, copays do count toward the annual out-of-pocket maximum, which is the total amount you are liable to pay for all your healthcare costs in any given year — including copay and coinsurance.

This video explains deductibles, coinsurance and copay: W322p driver(for mac os) tenda all for better networking.

Copay, Coinsurance and Deductible Example

Assume that a plan has a deductible of $1,000, $30 copay and 20% coinsurance.

The patient makes her first visit to a doctor in that year. Like every visit, she pays a copay of $30 at the time of the visit. Suppose the total bill for that visit is $700. The doctor is in the plan's network so the insurance company gets a discounted rate of $630 for that visit. After subtracting the $30 copay from the patient, the balance owed to the doctor is $600.

If the deductible had been met, the insurance company would have paid 80% of this $600 balance. However, since the deductible has not been met yet, the patient is responsible for the full $600.

The second visit is similar. The doctor's $500 bill is discounted down to $430 because of the preferred rate that the insurance company gets. The patient pays a $30 copay and so the balance is $400. Since the $1,000 deductible has not been met yet, the patient is responsible for this $400 too. Human resource machine mac download.

But the $600 from the first visit and the $400 from the second visit total $1,000 and serve to meet the deductible. So for the third visit, the insurance plan steps up and starts paying for healthcare costs.

In our example, the doctor's bill for the third visit is $600, discounted to $530. The patient still pays a $30 copay even after the deductible is met. For the $500 balance, the plans pays 80%, or $400 and the patient is responsible for 20%, or $100.

Other considerations

Navigating the health insurance maze can be challenging because there are other variables involved. For example,

- Some plans have different deductibles for in-network and out-of-network providers.

- Some plans do count copay amounts towards the deductible; most don't.

- Not all plans have an out-of-pocket maximum. For plans that do, you do not have to pay any more copay or coinsurance once you reach that limit in total out-of-pocket expenses for the year, .

- Some plans have a lifetime maximum so the insurance company stops paying for healthcare if they have already paid out that amount over the lifetime of the patient.

- Preventive care such as vaccines for children is usually covered 100%. Copays are waived and deductibles do not apply in such cases.

- Even with a deductible, it is often advantageous to have insurance because of the fee discount negotiated by an insurer with the provider. i.e. the fee that healthcare providers can charge for a particular service is lower if the patient is insured.

References

A copay after deductible is a flat fee you pay for medical service as part of a cost sharing relationship & health insurance must pay for your medical expenses.4 min read

1. Copay After Deductible: Everything You Need to Know2. Deductible: What Is It?

3. Are Coinsurance and Copay the Same Thing?

4. What Is the Difference Between Aggregate and Embedded Deductibles?

Copay After Deductible: Everything You Need to Know

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. Deductibles, coinsurance, and copays are all examples of cost sharing. If you understand how each of them works, it will help you determine how much and when you must pay for care.

Deductible: What Is It?

The amount you pay for medical services before your health insurance starts paying is known as a deductible. For example, if your insurance deductible is $1,500, you will be responsible for paying all of the pharmacy and medical bills until the amount you pay has reached $1,500. At that point, you begin sharing some future costs with the insurance company through copays and coinsurance.

Typically, a health insurance plan with a high deductible will require you to pay fairly inexpensive payments monthly. Although, initially, you will have to pay a significant amount up front if you were to need care. You may consider looking for plans that will pay for some services before you must pay your deductible. If you are mostly healthy, then it may be a good idea to increase your deductible as an easy way to lower your monthly payments or premiums. However, if you do this and then get sick, your medical bills in a year will be high.

Hospitalizations, blood tests, or surgical procedures may be services you pay for annually as part of your health insurance deductible. These services do not include routine care. Usually, preventative checkup services will just require that you make a co-payment. After the deductible has been met, your insurance will cover the expenses.

Copay Not Applicable Meaning

In a majority of circumstances, neither premiums nor copays count toward your deductible. Examples of health care costs that may count toward your deductible may include the following:

- Chiropractic care

- Hospitalization

- Mental healthcare

- Surgery

- Pacemakers and other medical devices

- Lab tests

- Physical therapy

- MRIs

- Anesthesia

- CAT scans

Are Coinsurance and Copay the Same Thing?

Copay and coinsurance are similar, but coinsurance is a percentage of costs, as opposed to a fixed dollar amount. A percentage of the amount an insurance company will allow a healthcare provider to charge for service gets determined when calculating the amount of a person's coinsurance. It is your share of the medical costs which get paid after you have paid the deductible for your plan.

An example of paying coinsurance and your deductible would be if you have $1,000 in medical expenses and the deductible is $100 with 30 percent coinsurance. You would pay $100 along with 30 percent of the remaining $900 up to your out-of-pocket maximum, which would be the most you would pay in a year.

Not all plans have coinsurance, but you may find plans with cost sharing of 50/50 or 20/80 coinsurance, or other combinations. Usually, if you are making small monthly payments for your plan, you may expect to pay more in coinsurance. Typically, the lower a plan's monthly payments, the more you will pay in coinsurance.

You will be required to pay coinsurance and copays only until you have reached your out-of-pocket maximum. As mentioned above, the amount of the maximum is the most you will pay for covered medical expenses. It includes the total of deductibles, coinsurance, and copays. After you reach the maximum, your covered prescription and medical costs will be paid by your insurance for the remainder of the year.

Some service may require that you pay coinsurance and copay. Copay is typically a fixed fee you pay when you receive medical service, although, the amount is not always the same. It can change depending on the type of care you receive. For example, a visit to the doctor's office may come with a copay of $25, but an emergency room visit may be $200.

If you have prescriptions that need to get filled often or you go to the doctor regularly, you might want to pick a health insurance plan that has low copays for drugs and office visits. If your plan covers an annual checkup in full and other preventative care services, you most likely will not have a copay at all for these visits. Certainly, you will be free of payment obligations if you have reached your out-of-pocket maximum for the year.

High Deductible Health Plans (HDHPs) have a different set of rules when it comes to copays compared to other types of plans. Usually, people with HDHPs must pay their deductible before the insurance will pay for any other services outside of preventative care.

What Is the Difference Between Aggregate and Embedded Deductibles?

When it comes to members of a family plan, it is important to know if you have an embedded or aggregate deductible. An aggregate deductible refers to the amount that must be met for any or all people under the plan before your insurance begins to pay for any medical coverage.

An embedded deductible means the family deductible, but there is also one for each family member. For example, a family plan has a family or overall deductible of $10,000, and the embedded deductible for the individual family member is $5,000. Then, say one person has expenses of at least $5,000; the insurance would cover any further care for the person. If another person gets sick and needs care but the cost is only $1,000, the family will have to pay that amount. There will still be $4,000 necessary for that person's overall deductible. Insurance starts covering medical costs sooner for the individual with an embedded deductible who has large bills than it would for the family to reach the overall deductible.

If you need help dealing with copay after deductible, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.